How to invest in Mastercard Share in UAE

Buy MasterCard shares in the UAE

MasterCard is a worldwide company headquartered in New York, the USA, with a diversified global payment processing business. MasterCard International is the most extensive banking payment system uniting 22,000 financial institutions from 210 countries. The company’s activities aim to serve individuals and legal entities, managing programs for issuing cards issued under the brands MasterCard, Cirrus, Maestro. In addition, one of the essential areas of the company’s activity is electronic payments online.

The unique history of this development payment system started in 1966. At the time, several American banks had signed an agreement to form a solid interbank card association. Two years later, the company began a fruitful collaboration with the Eurocard system. Finally, the name MasterCard itself was approved in 1979. One year later, the payment system has firmly integrated into one of the top positions in the world. By the end of the year, the total number of cards issued had reached 55 million.

In 2002, the MasterCard share company was reorganized into a joint-stock company. As a result, it has become a worthy competitor to the Visa payment system in the global market for inclusive holding plastic cards. And it was marked by an IPO on the 2006 New York Stock Exchange. After all that, the system was finally recognized as the most efficient and reliable. As a result, the company now makes $23 billion transactions a year.

Why Mastercard shares are in demand

The business grows and is considered the most efficient company in value-added per customer, making it the most prominent retailer. As a result, the company is always one step ahead of its competitors. In addition, it has consistently launched some new technologies to facilitate its existing and future business and strengthen the industry, which is why many are looking to start investing in MasterCard.

There are many other reasons why cards issued by MasterCard for direct customers have become very popular. The main reason is that cards are the simplest way to get some discounts and promotions. Cardholders and other third parties such as shops, restaurants, airports, and gas stations are taking advantage of issuing their cards to make more and more purchases with their purchasers. When a person uses their own MasterCard to make purchases from participating merchants, they receive some cash back as a reward.

Another reason people enjoy using MasterCard is that they have various options when they issue cards directly to customers. The highest example is the airline mile reward program. Financial institutions are a part of airline issues that give a MasterCard to buyers. This includes airline miles. It can often be redeemed for tickets. Once saved, the person earns enough miles to take them to the scheduled flight to the participating destination, whether they book a flight to the participating bank’s city or the customer’s leading destination.

The company also serves credit cards along with debit cards. Since most buyers today have good credit ratings, it is not surprising that many people hold MasterCard to issue cards directly to consumers. But there are still some people who have terrible credit ratings or do not need to go into any debt. After all, for these people who have a MasterCard is not such a bad idea. In addition, rewards offered by MasterCard credit card issuers attract many people to them.

In addition to reward factors, issuers of MasterCard cash advances and other credit lines provide various incentives. Among the most typical incentives for money back or rebate programs are lower credit card processing fees. Their Bonus points can also be used to offset high interest rates on the credit card.

How do you invest in MasterCard shares in the United Arab Emirates?

If you try to make the most of the current upswing and understand investing in MasterCard shares, you have too many different and unique options.

The amount of money you make depends on how much the company increases its price per share. The stock exchange is a risky business, and many people have lost their savings due to the stock market crash. Thus, you have to be extremely careful if you want to buy MasterCard shares. Do your research to see if it is worth buying MasterCard shares in the UAE.

You need to understand what strategy you will choose when trading. Generally, you first need to understand the short or long-term investments you are attracted to, and it has two sides advantages and disadvantages. With long-term investments, the investor or the trader does not need to make decisions too fast. There is always the opportunity to know more about the market situation from an observer’s point of view – also, a plus of the ability to reduce costs due to minimal operation. An adequately compiled portfolio does not require constant buying and selling of assets; Reasonable rehabilitation is sufficient once or twice a year.

If you want long-term investments, you need to limit the number of investments in one company: it is often no more than 10% of the portfolio and not buy more than two similar assets. On the other hand, short-term investments can bring enough profit if you apply a strong strategy.

The main thing is to find the best balance between profitability and taking risks. Some Short-term investments require a thorough analysis of the market and an immediate response to changes. It is essential to calm down and not panic.

Role of a trusted broker in Investment

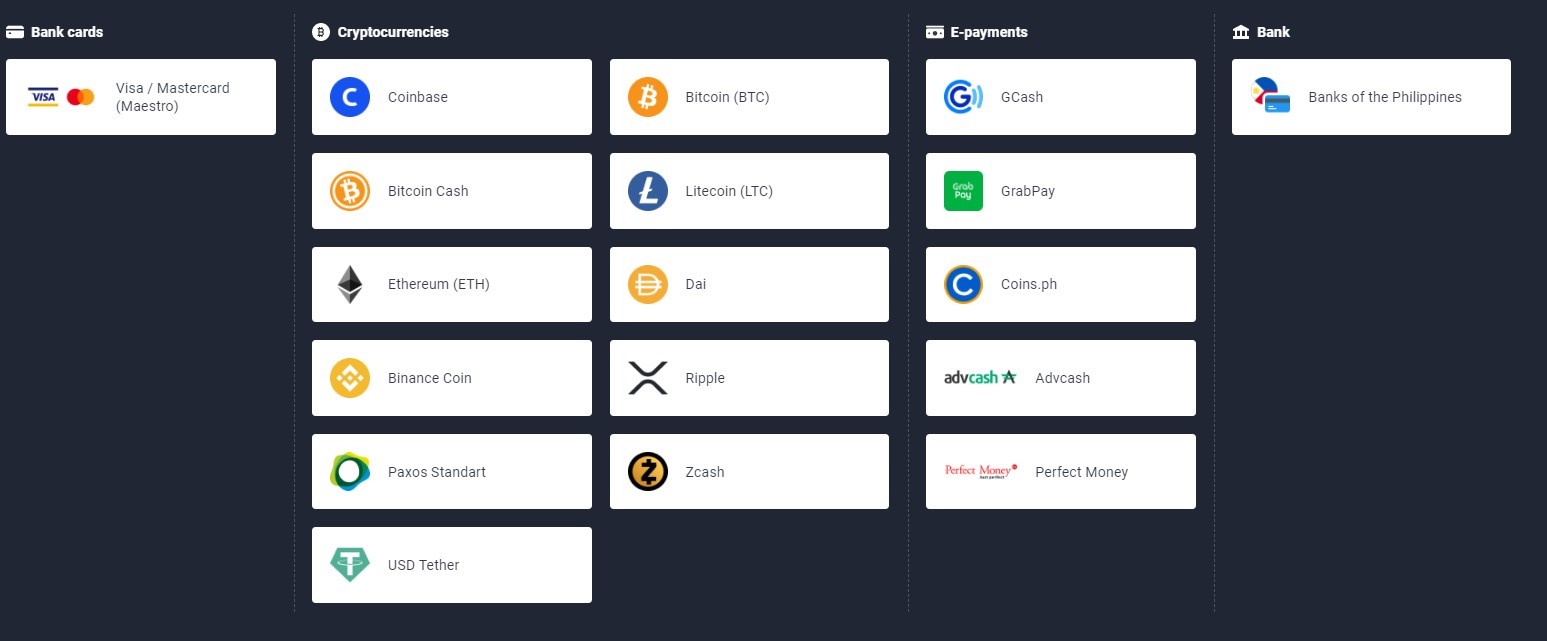

Either way, you will be responsible for your investment laws and money. You can try investing directly using a brokerage platform that specializes in this. This choice is entirely justified by many. First, by choosing a reliable and trustworthy online broker, you protect your money from fraudsters. Second, you have a 24/7 hotline or in-app support. Third, you always have access to the latest quotes, news, and all the information you need.

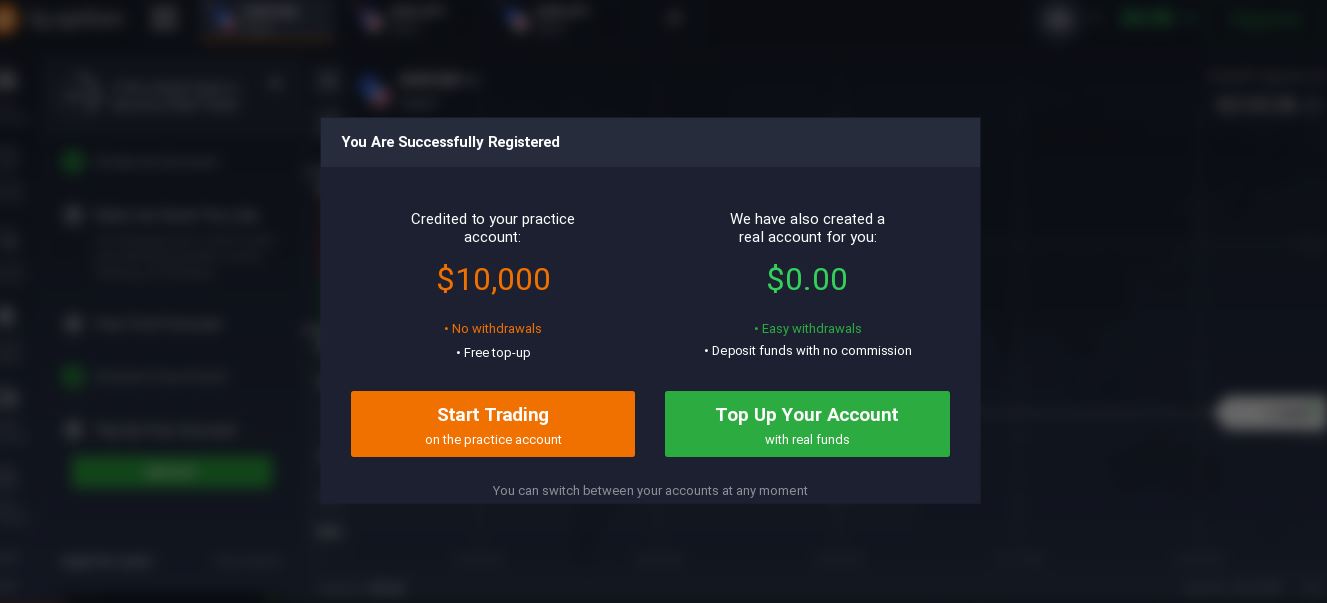

Alternatively, you can use our account to trade and invest in stocks in the United Arab Emirates. We have a natural or demo account, and it is very convenient; see for yourself. To open a live performance, you only need a minimum of $ 10 at your discretion. Once you have complete your work, you will have the opportunity to try out strategies with our trading video. It helps you to know how the platform works without the risk of losing your money.

If you want to learn about the platform before you start working with the trading account at total power, you can check if it is suitable for you; in any case, use a demo account. Remember that you cannot make a real profit by buying and selling stock while using a demo account. However, you can use the demo account as a tutorial.

However, MasterCard has several products that can be used as a long-term investment option.

One of the best long-term investment ideas offered by MasterCard is the MasterCard Growth Line of stocks. This line helps you to buy stocks that have been in existence for at least a year. This will enable you to diversify your profile without having to worry about investing in risky ventures. You can also find some outstanding growth shares that you can use whenever you want. In addition, the company has a long history of success in the stock market. So if you are ready to take risks, this could be an excellent start to a new income.

How do you buy MasterCard stocks in the UAE?

If you plan to start trading shares or stocks, you need to know how to buy MasterCard stock. Stocks are a prevalent investment vehicle in Venezuela, and it’s easy to see why. They offer you many benefits that other investments lack. In addition, there are various ways to buy in the current market and make a profit, among which will be trading on the exchange.

A favorite thing about stock or share market trading is the ability to trade on the stock exchange market through online platforms that offer traders and investors the ability to buy and sell stocks or shares. These programs act as intermediaries for exchanges between buyers and sellers. Also, all transactions made through these platforms are protected from fraudsters.

We offer to create an account today, it’s free, and it won’t take long, but it will allow you to join today’s exchange world.

Once you have an investment account, the next step is to buy and sell your stock. We offer you to watch some video tutorials on the complexities of the stock market, which will undoubtedly help you first. Again, we remind you that the stock site has a demo account that lets you learn to buy and sell stocks using actual trading terms. You can practice buying strategies until you perfect them. This will be effective for you when you start actual stock trading in the future.

Demo Accounts for practice

Demo accounts will help you figure out how much to invest in stocks and how to invest.

If you are fully confident in your knowledge, we recommend that you open a real account with a deposit of at least $ 10 to help you determine how much you are ready to invest and afford to lose your money. On the other hand, if you are still new, spending your money may be worth your while. This way, you will learn to manage your investment without losing your money.

Last but not least, you should make yourself more familiar with the different terms and conditions for trading stocks or shares used in the EU stock market. This will allow you to understand how it works.

The most important thing is to know how to read price charts. This is an essential aspect of buying MasterCard shares in the EU stock industry. The use of charts is significant in determining the worth of a claim, and this understanding must be known before you start you’re trading.

The MasterCard stock exchange has many advanced technical analysis tools to help investors analyze the latest trends.