Is Forex trading purely Luck?

Is Forex trading purely luck? How to reduce the factor of luck while trading Forex? These are the most common questions asked by most traders. In the financial markets, there is a certain degree of randomness. It is because retail traders are usually the last ones who get vital information. In this article, you will learn how to deal with randomness and luck in trading.

Here are some aspects you can learn to reduce luck in your trading:

Proper risk management

Risk management is the most vital thing in trading. If your strategy has been successful for over 100 trades, nothing is certain on your next trades.

For example, if you have a trading strategy with a 60% chance of win rate, there is still a 70% chance you will get four following losses in a row.

And if you are the type of trader with a 40% win rate, there is over a 50% chance that you will have 8 constant losses in a row.

Does this mean you are not profitable? Of course Not!

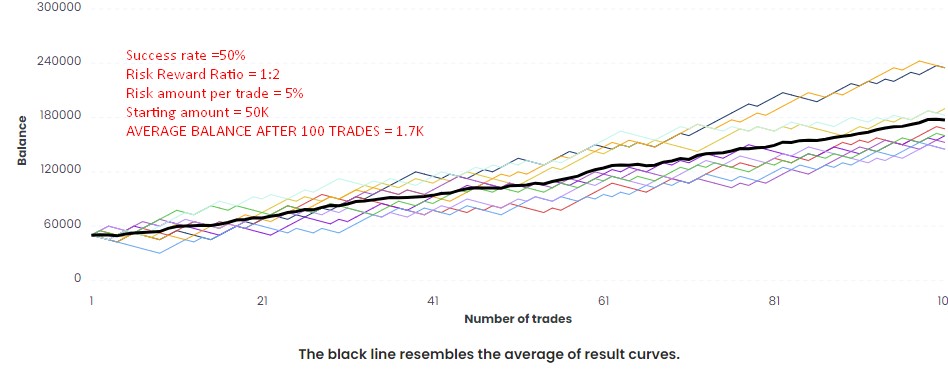

A proper risk-reward ratio can bring you profit even with less than a 50% success rate. If your success rate is 50% and risk reward ratio is 1:2, there is a high chance that your account will remain in profit. You can see in the result of the equity simulator, we have used Initial Capital=50K, Risking 5% in each trade, Risk Reward Ratio=1:2, and Number of trades= 100, which yields approximately 177K after 100 trades. It may not be easy, but you will know what to expect from your trading strategy once you stick to your strategy.

Dealing with unexpected global events

Now you are covered 99% of the time since you have a trading plan with proper risk management. But there is this 1% in trading where you have no control over our trading process. It appears when both planned and unplanned macroeconomic releases cause liquidity to be pulled from order books. So traders execute at much worse prices than expected.

For any planned events that have a significant market impact, the solution is simple. You have to be aware of news releases like FOMC, NFP, etc., beforehand. Check the economic calendar before each trading session. Also, pull your orders in advance, or try to adjust your exit limits as possible.

The traders must avoid any trading during high-impact news events. Usually, the experienced traders avoid trading 15 minutes before and 15 minutes after any high-impact news release. It can avoid unpredictable trading results during news events.

If you don’t want to trade with major macroeconomic releases, you might miss some volatile moves. Unplanned events and the flash crash in the market are the last part of the randomness in trading.

But, there is no way for you to avoid these.

Good thing that this may not happen very often. These might be once or twice a year, and they may only affect a few assets. Although during these events your stop-loss is likely to get triggered at a much worse price than you assumed, it is still better than not having stop-loss in the first place.

Swing traders who use larger stop-losses have a lesser chance to experience any damages to their accounts. It is because they use wider stop-losses with smaller position sizes. These events can have a much worse impact on day traders and scalpers who use bigger sizes with tight stop-loss.

Learn the important facts about Forex trading – Mistakes while applying StopLoss, Forex trading and LUCK, Maintaining a Trading Journal and Unrealistic expectation while trading Forex.

Conclusion – Don’t rely on your luck to make a profit from Forex trading.

Is forex trading purely luck? – In trading, reducing the factor of luck is not an easy thing to do. Building a trading plan with proper risk management rules is essential. It will help you to prepare yourself for whatever state the market brings you. It is always the knowledge and disciplined trading that wins rather than luck-based trading.

FxPro UAE Review

FxPro Forex Review UAEEstablished in 2006, with its headquarters in London, U.K., FxPro is a worldwide forex broker providing online trading services for a variety of financial instruments. It...

LiteFinance UAE Review

LiteFinance Forex Review UAELiteFinance (formerly known as LiteForex) is a digital ECN broker that has been providing its clients with top-tier liquidity across numerous markets since 2005. Clients...

XM Broker UAE Review

XM Forex Review UAE - IntroductionSince its foundation in 2009, XM has grown to have over 10 million clients, developing into a significant, reputable international investment company and a true...

Forex Trading in Dubai – How to start forex trading in Dubai

Overview - Forex Trading in DubaiForex trading in Dubai has gained immense popularity over the past few years due to its lucrative potential. The forex market, also known as the foreign exchange...

Forex Trading Education for UAE Traders

Introduction: Free Forex Trading Guide in UAEForex Trading Education for UAE Dubai Traders is a comprehensive program designed to equip traders in the United Arab Emirates with the necessary...

Commodity Trading in UAE

The UAE actively participates in the global commodities market, trading a variety of commodities with a long-standing history. It exports significant amounts of oil and gas, while also importing...

Exness UAE Review

Exness UAE - Islamic Forex BrokerExness UAE is a leading online broker in the United Arab Emirates (UAE). It is a part of the Exness Group, a global financial services provider with offices in more...

AvaTrade UAE Review

AVA Trade Review UAE | IntroductionAVA Trade UAE is a leading online trading platform that offers a wide range of services to traders in the United Arab Emirates. It is a regulated broker authorized...

Unrealistic Expectation in Forex trading

Are your trading expectations unrealistic while trading Forex?As a trader, do you trade with a small account? Do you experience any issues because you try to make a reasonable sum? In this article,...