XM Broker UAE Review

Since its foundation in 2009, XM has grown to have over 10 million clients, developing into a significant, reputable international investment company and a true industry leader. At present, XM employs over 900 experienced professionals in finance. Their extensive experience and support in over 30 languages make XM the broker of choice for traders at all levels across the globe. With the knowledge and resources of a large broker, we are well-prepared to help everyone reach their investment goals. In this XM broker review in UAE, we will learn about the broker’s features and its legality in the country.

XM Forex has extended its services to the United Arab Emirates, providing residents with an opportunity to engage in forex trading. With its strong reputation for providing a range of trading instruments, cutting-edge trading technology, and excellent customer support, XM Forex in UAE offers a reliable and efficient trading environment. Catering to both beginner and experienced traders, XM Forex focuses on delivering superior execution of trades, flexible trading conditions, and a wide array of financial instruments. This expansion into the UAE market further solidifies XM Forex’s position as a leading player in the global financial trading industry.

Check out our Binary Options Trading in UAE review here.

XM Account Types

Micro Account

- The least amount you can deposit is $5.

- With swaps and hedging permitted.

- There’s no commission charged.

- Spreads can go as low as 1 pip.

- You can leverage up to 1000:1.

- The smallest trade volume for both MT4 and MT5 is 0.1 Lots.

- There is protection against negative balance.

Standard Account

- You can start with a deposit as low as $5.

- Both swaps and hedging are permitted.

- There are no commission fees.

- Spreads can be as low as 1 pip.

- You can leverage up to 1000:1.

- Your account is safeguarded from negative balance.

- The smallest trade volume accepted is 0.01 lots.

XM Ultra Low Account

- The minimum deposit required is $5.

- With a leverage of up to 1000:1.

- There is protection from negative balance.

- Spread for all major currencies is 0.6 pips.

- No commission is charged.

- The minimum trading volume for Standard Ultra is 50 lots and for Micro Ultra, it’s 100 lots.

- Hedging is permitted; however, swaps are not allowed.

Shares Account

- The minimum deposit required is $5.

- With a leverage of up to 1000:1.

- There is protection from negative balance.

- Spread for all major currencies is 0.6 pips.

- No commission is charged.

- The minimum trading volume for Standard Ultra is 50 lots and for Micro Ultra, it’s 100 lots.

- Hedging is permitted; however, swaps are not allowed.

Demo Account

XM Demo Account is a valuable tool for individuals interested in forex trading. This demo account provides a risk-free environment for users to explore and understand the dynamics of forex trading without investing real money. It offers real-time market simulations, allowing users to practice trading strategies and familiarize themselves with the platform’s features. Moreover, the XM FREE Demo Account is easily accessible to users in the United Arab Emirates, making it an excellent resource for aspiring forex traders in the region. The account comes with virtual funds, facilitating users to gain hands-on experience in forex trading.

Islamic Account

The XM Islamic Account in UAE is a specialized trading account offered by XM, a globally recognized forex broker. This account is specifically designed to cater to the needs of traders who follow the Islamic faith and wish to engage in forex trading within the parameters of Sharia law. Under Islamic law, earning or paying interest (Riba) is prohibited. Therefore, the XM Islamic Account is a swap-free account, meaning that no interest is earned or paid on trades held overnight. This allows Muslim traders to engage in online trading while remaining in full compliance with their religious beliefs. It’s important to note that, despite its distinct features, the Islamic account offers the same trading conditions and terms as the standard XM trading accounts.

XM UAE Review – Tradeable Instruments

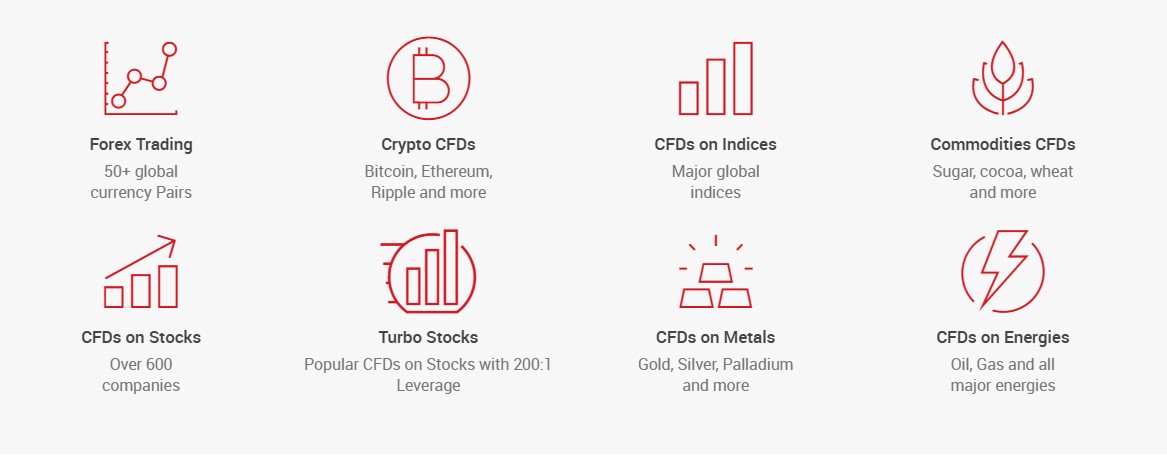

XM Broker is a globally recognized online broker that offers services in the United Arab Emirates. They provide a wide array of tradeable instruments for the benefit of their clients. These instruments include:

- Forex Trading: The broker offers forex trading services that allow clients to speculate on the price fluctuations of different currencies. This involves buying one currency while selling another, with the aim of profiting from changes in exchange rates.

- Cryptocurrencies: XM forex has expanded its offering to include trading in popular cryptocurrencies like Bitcoin, Ethereum, and others. This allows clients to trade on the volatility of these digital assets without the need to own them directly.

- Stock CFDs: Contract for Difference (CFD) trading on stocks allows clients to speculate on price movements of stocks without owning the actual stock. This offers the potential for profit regardless of whether the market is rising or falling.

- Turbo Stocks: This is a unique trading instrument that combines elements of options trading and CFDs. It allows for high-speed, high-risk trading on a wide range of stocks.

- Commodities: XM platform allows clients to trade on the price movements of various commodities like oil, gas, and agricultural products.

- Equity Indices: These are financial instruments that represent the price of a specific group of stocks. XM Broker offers trading on a wide range of global equity indices.

- Precious Metals: XM forex broker offers the ability to trade on the price movements of precious metals like gold, silver, platinum, and palladium.

- Energies: This includes trading on the price movements of energy commodities like oil, gas, and coal.

- Shares: Clients can also trade shares of companies from different sectors and regions around the world.

Trading Platforms

XM MT4 (MetaTrader 4)

XM broker was the pioneer in providing an MT4 platform specifically designed to enhance trading execution quality. It allows for MT4 trading without any requotes or rejections and offers a flexible leverage ranging from 1:1 up to 1000:1. It is compatible with Expert Advisors and comes with both pre-set and customizable indicators. It also enables one-click trading.

The platform provides an extensive technical analysis with over 50 indicators and tools for graphing. It has built-in support for both MetaTrader 4 and MetaQuotes Language 4. Capable of managing large order volumes, it allows for the creation of multiple custom indicators and time frames. XM MetaTrader 4 includes features for managing history database and exporting/importing historical data. The platform guarantees full data backup and security and has an internal mail system.

XM MT5 (MetaTrader 5)

The XM MT5, an advanced version of the XM MT4, offers an additional 1000 Contracts for Difference (CFDs) on stocks. This feature-rich platform is ideal for multi-asset trading, permitting transactions in Forex, CFDs on Stocks, Cryptocurrencies, Gold, Oil, and Equity Indices all within a single platform. There are no rejections or requotes and it offers a high leverage of up to 1000:1.

The XM MetaTrader 5 platform gives access to over 1000 instruments including Stock CFDs, Stock Indices CFDs, Forex, Cryptocurrency CFDs, Precious Metals CFDs, and Energy CFDs. Users enjoy the ease of single sign-in to 9 different platforms. The platform offers low spreads from 0.6 pips, full Expert Advisor (EA) functionality, and one-click trading. It accommodates all types of orders and offers over 80 technical analysis tools. Users can see the market depth of the most recent price quotes and are allowed to hedge.

XM MT4 Multiterminal

The XM MT4 Multiterminal is an ideal instrument for traders who want to efficiently control multiple MT4 accounts from a single terminal, utilizing one Master Login and Password. It permits up to 10 standard accounts, supports different order types, offers three allocation methods, and provides real-time management and execution.

MT4 WebTrader

This is readily available for both PC and macOS users without the need for download. It boasts features such as one-click trading, a range of options on the History tab, visibility of active orders on the chart, Close By and Multiple Close By trading requests, and the ability to modify the attributes of graphical objects.

MT5 WebTrader

The XM MT5 WebTrader, compatible with both PC and Mac OS, provides immediate entry to global markets without the need for extra software downloads. It offers access to more than 1000 instruments, including Stock CFDs, Stock Indices CFDs, Forex, CFDs on Cryptocurrencies, Precious Metals, and Energies. You can trade directly from your web browser and it supports one-click trading. It accommodates all kinds of trading orders and also allows for modifications of graphical object properties.

XM Mobile Apps

XM MT4 App

This is a local app that works seamlessly on both iPhone and Android, offering complete MT4 account features. It comes with three chart types, 30 technical indicators, and a detailed trading history log. The app also features an integrated news function with push alerts, along with live, interactive charts that can be zoomed and scrolled. The XM MT4 app can be downloaded on devices running iOS or Android.

XM MT5 App

This comprises more than 1000 trading instruments like Stock CFDs, Stock Indices CFDs, Forex, CFDs on cryptocurrencies, along with precious metals and energies. It comes with a fully operational MT5 account and accommodates all types of trading orders on its completely native iPhone and Android app. Additionally, it is equipped with integrated market analysis tools.

XM App

Engage in Forex, Cryptocurrencies CFDs, Commodities, Stocks, among other trades. Benefit from immediate order execution and no re-quotes. Personalize your account settings using the app. Perform deposits and withdrawals via your mobile. View sophisticated and up-to-date charts. Use more than 90 trading indicators. Keep up-to-date with recent news, analysis, and market studies. Works with both MT4 and MT5 platforms.

XM UAE Review – Trading COnditions

Order Execution Policy:

XM Broker ensures that all orders are executed at the best available price with no re-quotes. They offer real-time market execution which guarantees that your trades will be executed at the price you see on your screen.

Spreads:

XM forex broker offers tight spreads on all trading accounts. The spread is the difference between the buying and selling price of a currency pair, stock, or any other trading instrument. Lower spreads mean less cost for the trader.

Margin and Leverage:

The platform allows traders to trade on margin, giving them more trading power. They offer leverage up to 1000:1. Leverage enables traders to open larger positions than their initial deposit would allow. It’s important to note that while leverage can increase potential profits, it can also increase potential losses.

Overnight Positions:

When a position is kept open overnight, it will be subject to a charge called a ‘swap fee’. XM Broker provides a clear explanation of how these fees are calculated and when they will be charged. Traders can view the swap values for their chosen instrument at any time on the XM Broker trading platform.

Trading Hours:

XM Broker operates 24 hours a day, from Monday to Friday. This allows traders to take advantage of trading opportunities as they arise in different global markets. However, it’s important to note that different instruments have different trading hours. For example, Forex trading is available 24 hours a day, but stock trading is only available during the opening hours of the relevant stock exchange.

Trading TOols

Technical Indicators

- Ribbon Indicator: This tool uses varying lengths of moving averages to generate a ‘ribbon’ on a price chart, signifying the direction of market trends and potentially indicating reversals. It assists traders in pinpointing potential entry and exit points.

- River Indicator: Also referred to as the Kijun-Sen, this line acts as a foundation for the Ichimoku cloud and measures medium-term trends. A price above the River Indicator signifies a bullish market, while a price below it indicates a bearish market.

- Ichimoku Indicator: This comprehensive indicator provides data about support and resistance levels, trend direction, and momentum, comprising of five lines: Tenkan-Sen, Kijun-Sen, Senkou Span A, Senkou Span B, and Chikou Span. The interaction of these lines offers trading signals.

- Bollinger Bands Indicator: These bands serve as a volatility indicator comprising three lines. The middle line signifies a simple moving average, with the other two lines representing standard deviations from the moving average. The price touching the upper band may indicate an overbought market, while touching the lower band may suggest an oversold market.

- ADX and PSAR Indicator: The ADX (Average Directional Index) measures trend strength, while the PSAR (Parabolic Stop and Reverse) offers entry/exit signals. The ADX line enables traders to discern whether the market is trending or ranging, with the PSAR identifying potential reversals when the price crosses the PSAR dots.

- Analyser Indicator: This tool facilitates traders in assessing market conditions, identifying trends, and creating trading signals. It can be tailored to individual trading strategies and is applicable to any market and time frame.

MQL5 Trading Signals

XM broker’s trading signals are easy to set up and use, as they don’t require any installation due to their integrated service. They offer a wide variety of signal providers to choose from, without any need for intervention from the trader. The trades are automatically duplicated and can be used in conjunction with Expert Advisors. The innovative cloud architecture minimizes execution delays worldwide.

Forex Calculators

The XM online calculators offer customers the capacity to make accurate assessments at the right moment, optimizing their trades. The range of calculators on offer, such as the all-in-one calculator, the currency converter, the pip value calculator, the margin calculator, and the swaps calculator, help in evaluating your risk and monitoring your gains or losses for every trade made.

XM Deposit Options in UAE

- Credit/Debit Card: XM Broker allows the use of Visa, MasterCard, and other major credit/debit cards for deposits in UAE. The processing time is usually instant, but it can sometimes take up to 24 hours depending on the card provider.

- Bank Wire Transfer: This is another option for depositing funds into your XM Broker account. The processing time for bank wire transfers can take between 2 to 5 business days.

- E-Wallets: XM forex broker also accepts deposits through various E-wallets such as Neteller, Skrill, and Webmoney. The processing time for these options is typically instant.

- Local Bank Transfer: For UAE residents, XM Broker offers the option of local bank transfer. This method usually takes up to 24 hours to process.

- CashU: This is a popular payment method in the Middle East and North Africa, and it’s available for XM Broker users in UAE. The processing time for CashU deposits is usually instant.

- FasaPay: This is another E-wallet option available for those in UAE. It offers instant deposit processing times.

Remember to check the minimum and maximum deposit limits for these options, as they may vary. Also, while XM Broker does not charge any fees for deposits, the payment providers might.

XM Withdrawal Options in UAE

- Credit/Debit Card: This is one of the most commonly used withdrawal options in UAE. XM forex supports all major credit and debit cards, including Visa, MasterCard and Maestro. The processing time for card withdrawals is usually instant but can take up to 5 business days depending on the bank.

- Bank Wire Transfer: XM Forex also allows users in the UAE to withdraw funds through bank wire transfers. This method is safe and secure, but the processing time can range from 2 to 5 business days, depending on the bank and the country of residence.

- E-Wallets: XM Forex supports several e-wallets for withdrawals, including Skrill, Neteller, and WebMoney. These options are usually processed within 24 hours, making it one of the fastest ways to withdraw funds.

- Local Bank Transfer: This withdrawal option is available for traders in the UAE through a local bank transfer. The processing time usually takes up to 2 business days.

- XM MasterCard: XM Forex provides an exclusive XM MasterCard to clients in the UAE, which allows them to access their trading profits instantly and in any location. This method is usually processed instantly.

Remember, all these withdrawal options come with different fees and limits, so it’s essential to check XM Forex’s terms and conditions before choosing the best method for you.

Research and Education

XM forex broker is a forex trading platform that offers a comprehensive suite of resources to help traders improve their skills and knowledge.

- Research and Education: This includes in-depth market analysis and insights to help traders make informed decisions. XM broker also provides educational resources to help traders understand the complexities of forex trading.

- Live Education: XM forex provides live education sessions where traders can learn from experts in real-time. These sessions cover various topics, from basic trading principles to advanced trading strategies.

- Educational Videos: These are visual resources designed to make learning about forex trading easier and more engaging. The videos cover a wide range of topics, from the basics of forex trading to more complex concepts.

- Webinars: The platform hosts regular webinars where traders can learn from experienced professionals. These webinars cover a variety of topics and provide an opportunity for traders to ask questions and interact with the experts.

- Platform Tutorials: These are step-by-step guides that help traders understand how to use the XM broker trading platform. They cover everything from setting up an account to executing trades.

- Podcasts: XM broker offers podcasts that cover a wide range of topics related to forex trading. These podcasts provide traders with the flexibility to learn at their own pace and can be accessed anytime, anywhere.

- XM TV: This is a dedicated channel where traders can watch live market analysis, interviews with trading experts, and educational content. XM TV provides traders with up-to-date information on the forex market and helps them stay ahead of market trends.

Xm Broker Review UAE – Customer Support

- Contact Numbers: +501 223-6696 or +501 227-9421 – These are the numbers to reach XM Support for immediate help, often the fastest way to resolve issues.

- Email Address: support@xm.com – Customers can choose to email XM’s Support team, particularly for non-urgent matters. A response is generally received within 24 hours.

- Live Chat: XM Broker offers a live chat feature on their site as a convenient alternative to calling. This service is typically available around the clock.

Is XM Legal in the UAE?

XM a well-known and respected online trading platform that offers financial trading services. It is fully legal and permitted to operate in the United Arab Emirates (UAE). The company complies with the regulations and standards set by the UAE’s financial authorities, ensuring the safety and security of its clients’ funds. XM offers a wide range of financial instruments for trading, including forex, stocks, commodities, and indices. Its legality in the UAE allows residents and citizens of the country to engage in online trading activities seamlessly and securely.

XM Review UAE – Conclusion

In conclusion, XM Forex Broker UAE is a reliable and trustworthy platform for forex trading. It offers a wide range of trading tools and services, competitive spreads, and a user-friendly interface. With its robust security measures, it ensures the safety of the traders’ funds and personal information. Moreover, its excellent customer service and educational resources make it a suitable choice for both novice and experienced traders. Overall, XM Forex Broker UAE provides a solid foundation for a profitable trading experience.