LiteFinance UAE Review

LiteFinance (formerly known as LiteForex) is a digital ECN broker that has been providing its clients with top-tier liquidity across numerous markets since 2005. Clients have the opportunity to trade a broad range of currency pairs, including major and cross pairs, along with oil, precious metals, stock indices, blue-chip stocks, and a wide variety of cryptocurrency pairs through the LiteFinance broker (previously LiteForex). In this LiteFinance UAE review, we will explore different facets of this broker, such as the trading platforms they offer, the types of accounts available, the conditions for trading, their customer service, and more.

The platform is highly recognized in the United Arab Emirates (UAE), offering premium services in foreign exchange trading. This financial platform provides a bridge between international currency markets and investors in the UAE. LiteFinance UAE is recognized for its advanced trading tools, competitive spreads, and professional customer service. With a strong focus on customer satisfaction and regulatory compliance, LiteFinance broker ensures a safe, secure, and efficient trading environment for both novice and experienced traders.

Check out our Binary Options Trading in UAE review here.

LiteFinance UAE Account Types

ECN Account

- Required to deposit at least $50.

- The accuracy of the quotes has improved.

- The market execution comes with a guarantee of no re-quotes.

- There are no established stop and limit levels.

- Both scalping and news trading are allowed.

- Transactions can continue indefinitely.

- Trades are directly sent to liquidity providers.

- There is no conflict of interests.

- Access to the social trading platform is provided.

- The leverage ratio is 1:1000.

- Protection against negative balance is ensured.

Classic Account

- Required to deposit a minimum of $50.

- Guarantee accurate quoting and market execution without any requotes.

- The leverage ratio provided is 1:1000.

- Offers social trading.

- Floating spreads start from 1.8 points.

- No commission.

- Available in an Islamic account.

Demo ECN Account

A LiteFinance demo ECN account is a beneficial resource for both new and seasoned Forex traders. It lets you experiment with diverse trading tactics and methods without the fear of losing any money. You can try out different concepts and identify the most effective system that will yield profits when you engage in trading on an actual account.

Islamic Account

LiteFinance forex, a leading financial services provider, offers an Islamic Account in the United Arab Emirates (UAE) specifically designed to comply with Sharia law. This account type adheres strictly to the principles of Islamic finance which prohibits earning interest or “Riba”. Instead of interest, the LiteFinance Islamic Account operates on the basis of trade and investment. Notably, it eliminates any hidden fees, commissions, or swap charges, ensuring transparency and fairness. This account is an excellent opportunity for UAE’s Muslim population and others interested in ethical and religiously compliant trading.

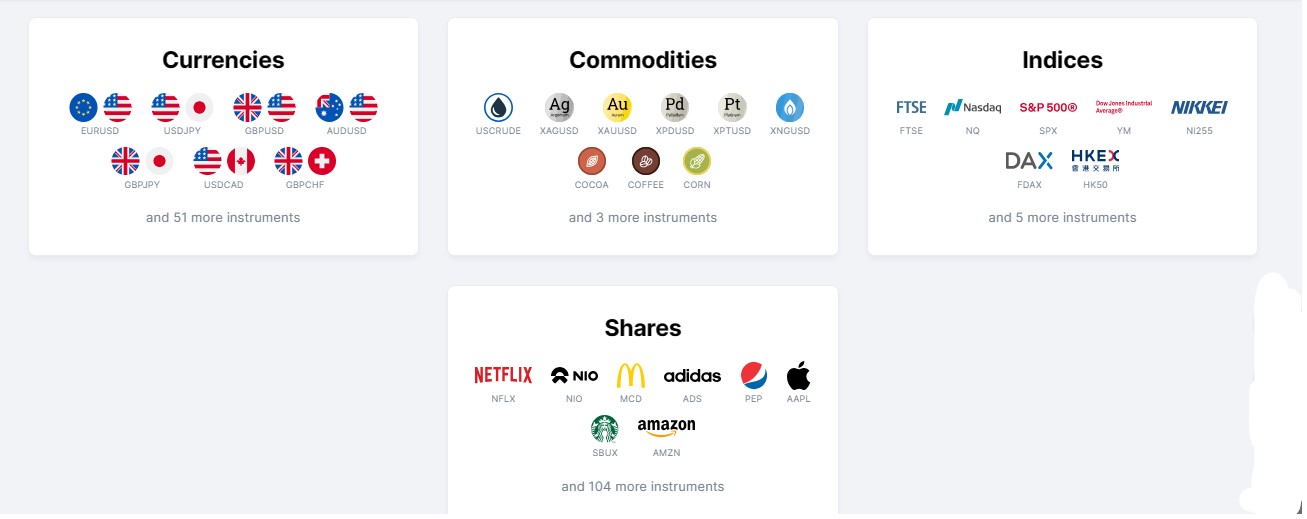

LiteFinance UAE Review – Tradeable Instruments

As a trader with LiteFinance in UAE, you have access to a wide range of instruments for trading. These include:

- Forex Trading: This is a global marketplace for exchanging national currencies against one another. You can trade on the values of different currencies such as the US Dollar, Euro, British Pound and many more.

- Global Stock Indexes: These are indexes that measure the performance of stocks from around the world. Examples include the S&P 500 (USA), FTSE 100 (UK), Nikkei 225 (Japan), and more.

- Commodities: You can trade various commodities such as oil, gold, silver, natural gas, coffee, wheat, etc. These goods are often traded in futures contracts.

- CFD (Contract for Difference): This is a contract between a buyer and a seller that stipulates that the seller will pay to the buyer the difference between the current value of an asset and its value at contract time.

- NYSE (New York Stock Exchange): This is the largest equities-based exchange in the world, based on total market capitalization. You can trade the shares of companies listed on this exchange.

- NASDAQ: This is a global electronic marketplace for buying and selling securities. It is known for its high concentration of technology stocks.

- EURONEXT: This is a European stock exchange that features markets in Belgium, France, Ireland, the Netherlands, Portugal and the UK.

- LONDON LSE (London Stock Exchange): This is one of the world’s oldest stock exchanges and can be traced back to 1698. You can trade shares of companies listed on this exchange.

- XETRA: This is an all-electronic trading system based in Frankfurt, Germany. It offers increased flexibility for seeing order depth within the markets and offers trading in stocks, funds, bonds, warrants and commodities contracts.

Trading Platforms

- LiteFinance MT4 (MetaTrader 4) is a popular platform for conducting Forex trading and analysis. It allows users to trade in a variety of areas such as currencies, shares, precious metals, and CFD on stock indices. Clients of LiteFinance broker can access the MetaTrader 4 trading platform by downloading it along with its mobile applications for PDA, iPhone®, iPad ™, and Android.

- MetaTrader 5 is a more advanced forex trading platform with additional features and tools compared to the previous version. LiteFinance, a forex broker, provides the LiteFinance MT5 software for download on both desktop and iPhone®.

- cTrader is a trading platform that provides numerous advantages for Forex and CFDs traders. It features an intuitive interface, sophisticated charting tools, prompt execution, Level II Market Depth, Autochartist, and expanded algorithmic trading capabilities. These attributes make LiteFinance cTrader an adaptable and robust platform for online trading.

- LiteFinance mobile Forex applications are available at no cost. You can utilize these applications on your tablet or smartphone to view daily analysis, trading signals, and strategies. They are compatible with both Android and iOS platforms, support over 8 languages, and receive regular updates.

LiteFinance UAE – Trading TOols

- Economic Calendar is an essential resource for Forex traders that keeps them updated in real time. This tool offers data on crucial macroeconomic signals and occurrences that impact the performance of a particular trading tool. The economic calendar is particularly beneficial for traders who rely on fundamental analysis for their trading plan. LiteFinance forex broker clients can use the economic calendar to stay abreast of the most recent news and trade more effectively and with greater confidence in the Forex market.

- Forex Analysis & Market Predictions – Gain understanding from seasoned analysts about the patterns and shifts of significant currency pairs, commodities, and digital currencies. Explore daily reviews and viewpoints on the worldwide markets.

- Analytical Materials from Claws&Horns – The team at Claws&Horns are seasoned professionals who are highly skilled in analysis. Clients of LiteFinance now have access to a wide range of analysis including recent predictions, exclusive evaluations, specialist viewpoints, among other things. These analytical resources are crucial for prosperous trading.

- Trader’s Calculator – The LiteFinance Trader’s Calculator allows you to evaluate the possible profit or loss of an existing or intended position. To use it, you only need to provide details such as your account type, currency, trading instrument, lot size, and leverage size.

- Fibonacci Calculator by LiteFinance forex aids in trading and calculating price retracements, thereby enhancing your Forex strategy. This potent instrument of technical analysis allows you to refine your trading in the Forex market.

- Exchange Rates – Keep yourself informed about the latest fluctuations in exchange rates for all pairs to make intelligent trading decisions. In this section, you can also monitor live currency rates and observe their historical shifts on Forex over the previous two years.

- Economic News – A concise overview of the worldwide economy and finance, derived from the most recent foreign exchange and stock market trends.

LiteFinance Deposit Options in UAE

- Bank Transfers: LiteFinance allows clients in UAE to deposit funds using bank transfers. The processing time for this deposit option is usually 2-5 business days. Be aware that some banks may charge a fee for this service.

- Credit/Debit Cards: Accepts deposits via credit or debit cards from major providers such as Visa, MasterCard, and American Express. The processing time for this method is instant, however, your bank may charge a small transaction fee.

- E-Wallets: E-wallets such as PayPal, Skrill, and Neteller are also accepted by LiteFinance for depositing funds. The processing time for e-wallets is usually instant, but fees may apply depending on the e-wallet provider.

- Cryptocurrencies: You can also deposit funds into your LiteFinance account using cryptocurrencies like Bitcoin, Ethereum, and Litecoin. The processing time for this method varies, usually taking anywhere from a few minutes to an hour.

- Local Bank Transfer: For those who prefer to use local banking services, LiteFinance broker accepts deposits through UAE local banks. The processing time for local bank transfers can be anywhere between 1-3 business days.

- Wire Transfer: Another option for depositing funds is through wire transfers. This can take between 2-7 business days to process.

- Mobile Payment: Some mobile payment platforms like Apple Pay or Google Pay are also accepted by LiteFinance. The processing time is instant for mobile payments.

Remember, the processing times are subject to change and may vary depending on the deposit method and the bank or service you’re using. Always check with your bank or payment provider for the most accurate information.

LiteFinance Withdrawal Options in UAE

LiteFinance, a popular financial platform, provides various withdrawal options for its users in the United Arab Emirates (UAE). Here’s a comprehensive list of these options, along with their respective processing times:

- Bank Wire Transfer: This is one of the most commonly used withdrawal options. The processing time is usually between 2 to 5 business days. However, the exact duration may depend on the specific bank and its policies.

- Credit/Debit Card: LiteFinance allows users to withdraw funds directly to their credit or debit cards. The processing time for this method is typically between 24 to 48 hours.

- E-Wallets: LiteFinance forex broker also supports various e-wallets like Neteller, Skrill, and PayPal. These methods are usually instant, but in some cases, it may take up to 24 hours for the funds to reflect in your e-wallet account.

- Cryptocurrency: With the increasing popularity of cryptocurrencies, LiteFinance has also incorporated this withdrawal option. The processing time can vary significantly depending on the specific cryptocurrency, but it’s usually done within an hour.

Please note that the processing time can vary based on factors such as the withdrawal amount, the method used, and the time of the request. Also, additional verification procedures might be required for larger withdrawals, which could extend the processing time.

Lastly, always check LiteFinance’s platform for the most current information as processing times and withdrawal options might vary.

Research and Education

- LiteFinance Webinars comprise a range of online seminars led by seasoned traders and trading professionals. The aim of these webinars is to advise both beginner and experienced traders on an array of subjects such as trading strategies, market trends, risk management, and more.

- The Forex Glossary is an extensive compilation of frequently used terms and definitions in forex trading, designed to assist traders in understanding industry-specific language and communicating effectively.

- Forex Books consist of a variety of publications that offer insight into forex trading, covering a multitude of topics such as trading strategies, risk management, market analysis, and trading psychology.

- Trading Strategies are structured plans used by traders to develop a profitable trading process. LiteFinance UAE offers various types of trading strategies suitable for diverse traders and market conditions, which have been proven to enhance trading performance.

- LiteFinance Traders’ Reviews is a platform where traders can share their experiences, strategies, tips, and reviews of the LiteFinance platform, providing valuable knowledge to other traders and aiding them in making informed decisions.

Is LiteFinance Legal in the UAE?

LiteFinance is legal in UAE. It complies with all the stringent regulations and guidelines set forth by the UAE’s financial regulatory bodies, ensuring a secure, transparent, and fair investment environment. It offers a broad range of financial services, including asset management, investment advisory, and brokerage services. The legality of LiteFinance forex UAE demonstrates the country’s commitment to fostering a robust and diverse financial sector, while also providing investors with a variety of reliable and secure financial service options.

LiteFinance UAE Advantages

- User-Friendly Interface: Provides a user-friendly interface that makes it easy for users to navigate and manage their investments.

- Diversified Investment Options: Offers diversified investment options, giving investors the opportunity to invest in a wide range of assets. This helps to spread risk and increase the potential for returns.

- Online Access: Allows users to access and manage their accounts online, providing flexibility and convenience. This means that users can manage their investments anytime, anywhere.

- Competitive Rates: LiteFinance offers competitive rates on investments, allowing users to maximize their potential returns.

- Transparent Fees: Provides transparent fee structures, ensuring that users are aware of all costs associated with their investments. This transparency helps to build trust and confidence among users.

- Professional Support: Offers professional customer support, providing users with assistance and guidance whenever they need it. This ensures that users can make informed investment decisions.

- Customized Solutions: LiteFinance offers customized investment solutions, catering to the unique needs and goals of each investor. This personalized approach helps to ensure that users get the most out of their investments.

- Security: Prioritizes the security of users’ funds and personal information. They use advanced security measures to protect users from fraud and unauthorized access.

- Regulatory Compliance: LiteFinance is compliant with UAE’s financial regulations, ensuring that users’ investments are safe and secure.

- Financial Education: Provides financial education resources, helping users to understand the investment landscape and make informed decisions.

- Innovative Technology: LiteFinance uses innovative technology to provide users with real-time updates on their investments, market trends, and more. This allows users to stay informed and make timely investment decisions.

- Global Market Access: With LiteFinance, users in UAE can access global financial markets, providing them with a wider range of investment opportunities.

LiteFinance Review UAE – Conclusion

In conclusion, LiteFinance in the UAE has proven to be a valuable resource for individuals and businesses seeking financial solutions. Its services are comprehensive and cater to a wide range of needs, from personal loans to business financing. The company’s commitment to transparency, reliability and customer satisfaction sets it apart in the competitive UAE financial market. However, potential clients should always conduct their own research and consider all options before committing to any financial agreements.